My dear Loyal Readers deserve this little story. You're going to love this because at the height of my obsession, you sent me messages encouraging me to just buy it! And so I did. But I'm getting ahead of my story.

Once upon a time, a silly girl fell in love with the ugliest designer bag in the world.

I first told you about my Tod's D Bag love affair in my old beauty blog way back in the late 2000's. I remember the comments saying they'd never heard of Tod's before. I don't care if no one knew Tod's. For me, it was Princess Diana's bag and that was enough reason to own one. I reaffirmed my desire for that ugly plain bag here: Yes, I still want something from Tod's. Two years later, with Kate Middleton (plus Hollywood celebs and local fashionistas) also caught out and about with the Tod's D Bag , I promised myself I would own one one day.

But I could never bring myself to buy it because I just didn't have the money. And then when I finally did have the money, I realized it wasn't even that beautiful a bag to splurge on. It's really quite boring. But I liked its plain ugliness, its anonymity, and the fact that no one owned one. Everyone I knew had more than a few Louis Vuitton, a couple of Pradas and Goyards, a Ferragamo here, a Fendi there, a Celine, a Chanel, and even an Hermes. But a Tod's? Nobody owned a Tod's. The bag that two princesses owned? The bag that Amy Dunne, the most insane movie wife, carried??? It's the most understated, under-the-radar luxury designer bag. And that's why I was obsessed with it. But I didn't want to fork over that much cash for it.

So at first, it was around 70K. Then every year, it got more and more expensive until finally, it was 115K. I figured it was never going to get cheaper so I should buy it. But, being a mom by then, I very quickly snapped out of that insanity when I realized the better choice isn't always the easiest choice. So I let go of the dream but asked God anyway that if ever He can throw one my way, I'd appreciate that very much.

Now I've said here before that we must never treat God as a wish-granting fairy. That said, I've had some prayers answered (do you remember my Ethan Allen headboard?). So a year after I bid good-bye to Tod's, one of my friends said that I could buy from Japan. In Japan, she said, people discarded their designer bags quickly. So I went to the eBay store she told me about and I was astounded to find the exact Tod's D-styling Bauletto Bag in dove grey that I wanted. And it was in pristine condition. It was practically brand new! I couldn't believe it!

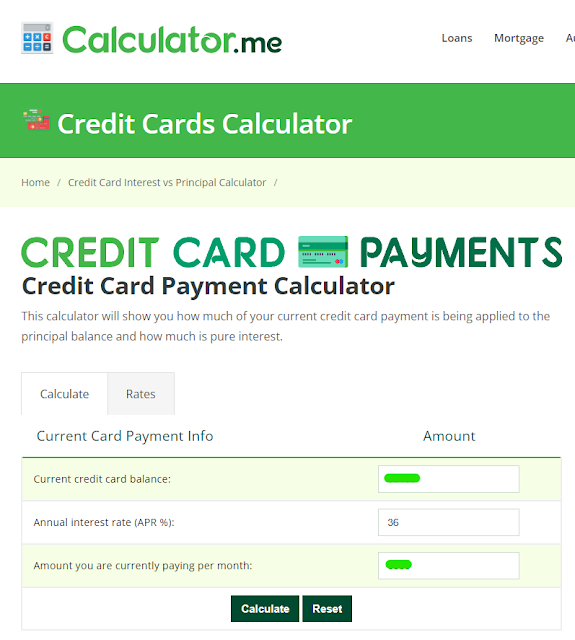

Now, on eBay, it's an auction and the starting bid for the bag was Php 4,500. I couldn't believe it! I saw that the bidding was open for 7 days, and that made me lose hope because bids can go up to crazy amounts. There's automatic bidding so I started my bid at Php 5,000 and set my final bid for Php 15,000 and I told myself I won't check the bidding war till after the auction ends. Because sometimes, in the last few minutes of the auction, that's when the bids come in and you get excited and carried away and bid and bid and bid, then the next thing you know, you've pledged your entire savings and retirement plan for something dumb like a bag.

So 7 days later, I checked eBay and to my shock, I had been the only bidder! So I won the bag of my dreams for only Php 5,000! Shipping was Php 4,500. I paid for it with my credit card and 3 days later, I got the big box of royal bag joy. I opened it and my Tod's D-styling Bauletto Bag looked brand new. It smelled brand new. It felt brand new. I was so happy!

I don't know why I never blogged about this. I quietly debuted my Tod's D Bag in this post - A peek at Tod's SS 2017 collection - but it's such a bad photo so nobody noticed my dream come true hahaha

This is my most recent outing with it. This was literally today!

So now here's the amazing part.

The purchase never appeared on my credit card bill. This could be for a variety of reasons. In my case, the merchant could've failed to process the transaction correctly, or there was a technical glitch. Or there could've been a delay.

I waited and waited for the charge and then forgot about it till maybe a year or so later. So I called up the bank and told them they never billed me. They made me wait on the line for minutes on end, hunting down the purchase. They never found it. They then told me that since it's been more than a year, it's considered "outside their window for action." A bank allows disputes for billing errors within 60 to 120 days so they said I could try contacting the merchant to ask if they want to reprocess the transaction. So I (very reluctantly I will admit) sent a message to the store. They never replied. You know why? The eBay store didn't exist anymore.

So I got my Tod's D Bag for free.

FREE! FREE! FREE!

After all those years. After all that hemming and hawing. After all that praying. I got my silly bag for free!

You gotta admit that's incredible.

So I have the bag of my dreams. That I got for free. That no one knew about. Until today.

And that's my Tod's D Bag story. Oh, by the way, soon after I got my bag, Tod's discontinued it so now it's a collector's item. I can't sell it, though. It's really so used and battered. The leather's gotten softer, so it's slouchier and uglier. But that made me love it even more and so now I'm going to use it happily ever after!