I wrote an article for Wyeth ParenTeam, 5 Steps to Save for Your Child's College Tuition. It has an equation there that predicts tuition years and years from now. It’s all estimates but you get a good idea of how much you’re going to suffer and for how long hahahaaa huhuhu.

The equation goes: Current tuition multiplied by 1 plus Interest [P x (1+I)] raised to number of years (N).

In my article, the financial expert I interviewed said, “On your phone, just type 300,000 x 1.10 then press the equal sign 8 times. We have just projected that if tuition fees increase by 10% a year for 8 years, then Php 300,000 today will be around Php 644,000 in 8 years, or around Php 778,000 in 10 years.”

|

| That's where I spent 4.5 years of my life, the College of Arts & Letters |

Boy. Almost a million pesos for one year in college. A short-term financial solution is to get a loan. My mother got tuition loans from her job all the time so she could send our eldest brother to school. My and my younger brother’s education was free (thank you, Philippine taxpayers!) while my younger sister’s education wasn’t that expensive either. All our college was subsidized because we went to that state university in Diliman (thank you again, Philippine taxpayers!) so Mama didn’t have to borrow so much anymore.

Some schools accept credit card payments but that’s something I want to stay away from because I was a credit card-aholic (but my marriage saved me). Plus, credit card interest rates are jumping this March! College tuition is just too big an amount to put on a card.

I’m not going to think of college because we already have a college fund for them (that’s another solution: invest in a mutual fund or an insurance policy with regular endowment payouts!). Also, I’m hoping my boys go to my alma mater and be a scholar like me.

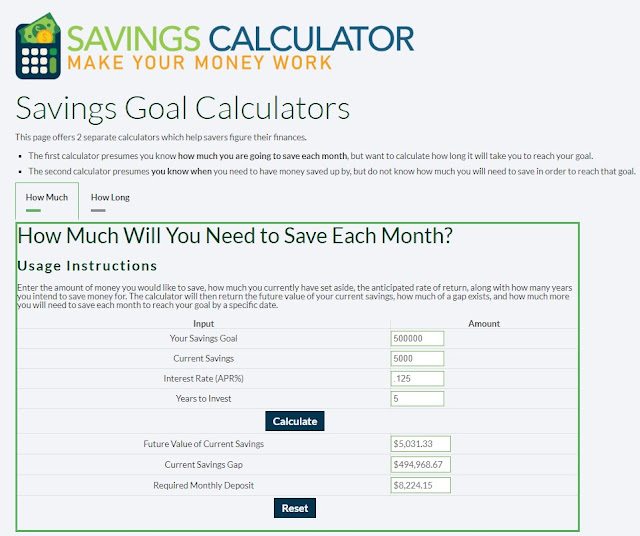

So let’s just compute for high school since my kids are 12, 10, and 8. Let’s do my eldest son’s tuition. So his Grade 6 tuition now is Php 150,000. So if tuition increases by 10%, I’ll need to pay Php 165,000 for 7th grade. That means my tuition budget is Php 13,750 a month for a year. Doable!

But then I have 2 more kids. That means Php 495,000 a year. That’s okay. I just need to set aside Php 41,250 every month. Thanks to my new job, this is still doable.

Now my kids go to a school near our place so we don’t spend a lot of money on the school run. Not a lot of time on the road either. It’s a big deal because they used to go to another school just 5 kms away and the school bus service cost me an additional Php 9,000 a month (or Php 90,000 a school year). Plus an hour and 2 hours in traffic, morning and afternoon respectively. Transferring to a nearer school made such a huge difference in time and money saved!

But then here comes the crazy part: We’re thinking of sending our boys to that boys’ school in Katipunan. We have our reasons although they pale after I tell you this: That school is almost 12 kilometers away from our home and difficult to get to because traffic to and fro is hellish. Since my husband also has a full-time job, he won’t be able to do the school run (he can do this now because our current school is very near).

So if the boys go to that boys’ school, we’ll have to get them a bus service. I asked my friend who lives near me how much she pays for her son’s bus service from our city to that school. A whopping Php 10,000 a month! That’s Php 100,000 x 3 = Php 300,000 a year just on the school service!

I don’t think I can afford Php 495,000 tuition + books + uniforms + baon + Php 300,000 bus service, mommies. It's just illogical.

So we were prepared enough to save for college but I don’t know if we can even get them there because grade school and high school are so damn pricey!

Lots of thinking to do.

*Photo by Kat Fernandez on Unsplash